A capital transaction advisory serving transformations

expertise

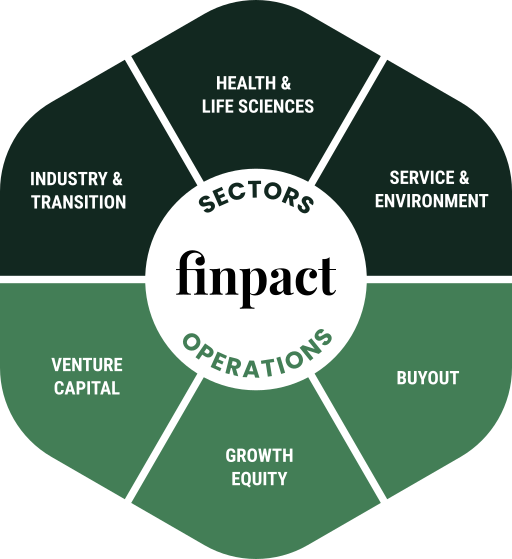

We support companies contributing to broader value as they undergo industrial, organisational and technological transformations.

Drawing on our transactional expertise, we help companies structure strategic decisions around robust business models and strong overall performance.

3 areas of expertise

Structuring transactions for companies engaged in productive, environmental and human transitions.

01.

Industry

& Transition

- Industrial equipment / CDMO

- Sustainable farming

- Circular economy

- Energy transition

- Reshoring & short supply-chains

Purposeful production while mitigating the adverse impacts of consumption

02.

Health

& Life sciences

- Pharmaceutical company / CRO

- Nutrition

- Biocontrol

- Agri-Tech

- Bio / Med-Tech

Embedding environmental health into human-health progress

03.

Services

& Environment

- Logistics

- Transport

- Business services

- Resource management

- Digital & Data

Serving people while respecting planetary boundaries

3 development stages

A tailored approach for each entrepreneurial journey, with a single objective: connecting vision to value by executing the right transaction with the right partner.

01.

Venture

Capital

02.

Growth Equity

03.

Buy-out

Multidisciplinary expertise to execute your transaction

Fundraising

Benefits

- Financing

- Access

- Expertise

Partners

- Business Angels

- VC funds

- Family offices

Buy out

Transaction scope

- Asset structuring

- Equity injection

- Shareholder exit

Partners

- Strategics

- Financial

sponsors

Acquisition

Typology

- Merger

- Joint-venture

- Strategic partnership

Targets

- France

- Europe

Strategic advisory

- Exit strategy

- Growth strategy

- Management Package

- Valuation & Fairness opinions