Serving a contribution-driven economy through ethical capital execution

Mission

Our raison d’être has been part of our bylaws since inception

In 2025, after a collective effort with our stakeholders, we elevated this raison d’être into a formal corporate mission.

It now stands on three statutory pillars.

01.

Provide the market with an alternative advisory proposition

anchored in business integrity and sound judgment

Trust : Build lasting relationships based on proximity and reliable execution.

Discernment : Conduct transactions aligned with strategic priorities by systematically clarifying client objectives.

Average mandate length

Deals preceded by strategic advisory

Efficiency : Enhance our methods with robust digital tools to accelerate execution and improve operational quality.

Accessibility : Extend high-end deal execution to all economic players through success-based and interest-aligned models.

success rate

Average fee

(% of transaction value)

02.

Enhance the efficiency

and accessibility

of our advisory services.

03.

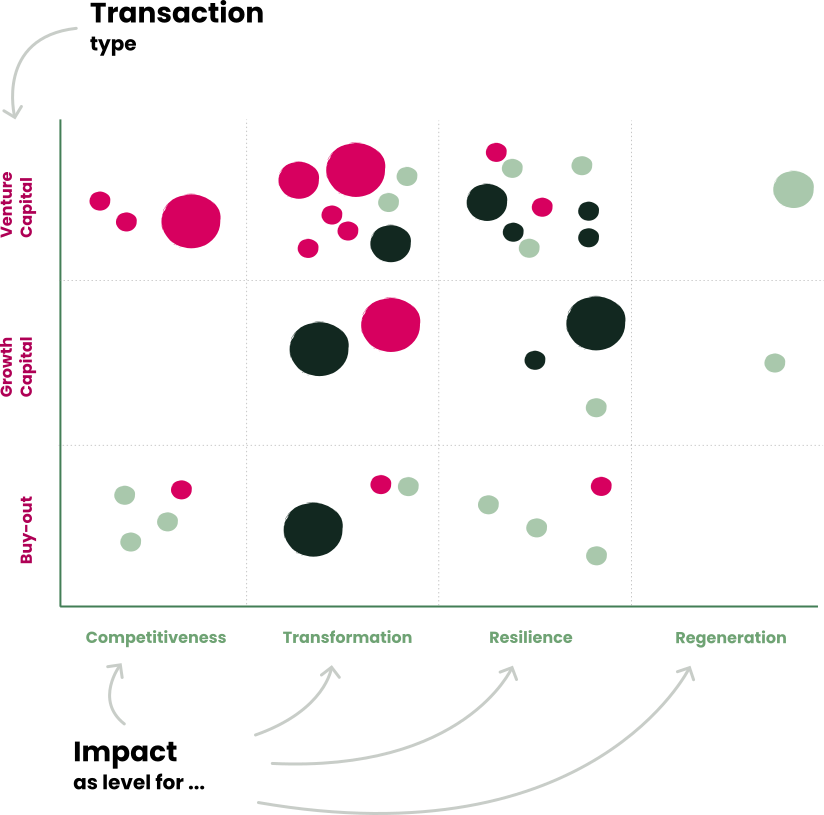

Contribute, through our interventions, to accelerating sector transformation

by carrying out useful transactions

Utility : Channel the right capital partners toward more resilient business models while strengthening projects’ environmental, social and territorial impact.

Alignment : Foster convergence between economic performance and the collective value by acting on company selection, transformation, and awareness of overall performance.